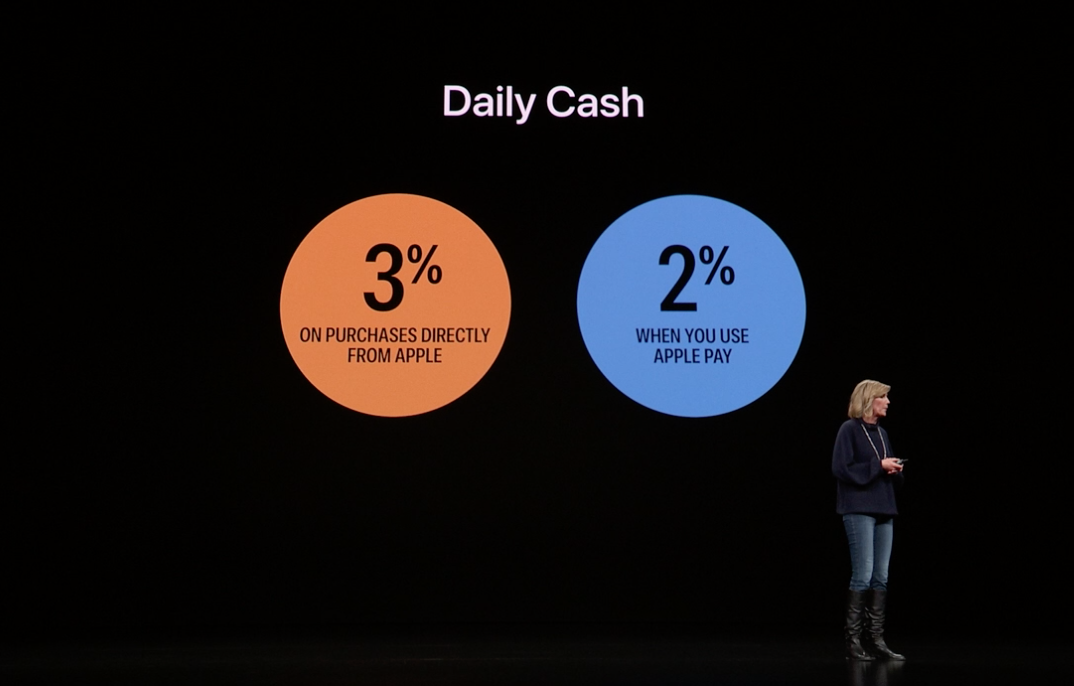

Not even hidden ones and that includes all the usual fees traditional. The 0-annual-fee Apple Card earns 3 cash back on Apple purchases as well as at select merchants and through select apps and 2 back on everything else but only if.

Apple Introduces Its Own Credit Card The Apple Card Techcrunch

Apple Introduces Its Own Credit Card The Apple Card Techcrunch

On the Apple Card website Apple says the card has no fees.

How much is an apple card. You can apply for Apple Card when you buy a new iPhone iPad Mac or other eligible Apple product with Apple Card Installments. While Apple Card does bring solid rewards and impressive money management tools it will also affect your credit report when you apply for it. Apple Card is poised to become the Apple Music of credit cards for anyone that has an iPhone - the service people sign up for by default since its built into the software.

As Apple Card became more widely available on Tuesday August 20 Apple announced that it will offer 3 Daily Cash on purchased made using the card from Uber and Uber Eats. But if youre considering getting one. This tells the issuer whether you can afford to take on more debt and how much and it sets your credit limit accordingly.

When you first apply for an Apple Card or any other credit card for that matter the cards issuer will calculate your debt-to-income ratio by comparing your income to the amount of debt you owe. Global Nav Open Menu Global Nav Close Menu. Apple Card Monthly Installments lets you pay for new Apple products with interest-free low monthly payments.

There is no annual fee for Apple Card nor is there a late fee. Apple Watch Series 6 deal at Amazon. And get 3 Daily Cash back all up front.

On the Apple Card site Apple says the variable APRs range from 1299 to 2399 percent as of August 2 2019. Your Daily Cash is automatically added to your Apple Cash card in Wallet. Down to 299 for a limited time.

Getting ready to experience all that Apple Card. You also get unlimited 3 Daily Cash back on purchases you make at select merchants when you use Apple Card with Apple Pay. If your application is approved with insufficient credit to cover the cost of the device you want to buy you can choose a different device thats covered by your credit limit.

However one Gizmodo commenter on a previous Apple Card story noted they were approved for a limit of 6000 at the highest interest rate of 2399 percent despite having a FICO score of nearly. Make sure you have the credit score to get approved for it. 6 the Apple Card finally became available to all qualifying members on Aug.

Thats slightly lower than the originally announced rates of 1324 to 2424 percent. With Apple Card Monthly Installments you get 3 Daily Cash on the purchase price of your new eligible Apple product including taxes and shipping charges. Customers will also get 3 percent Daily Cash on all purchases made directly with Apple including at Apple Stores on the App Store and for Apple.

Apple Card gives you unlimited 3 Daily Cash back on everything you buy from Apple whether its a new Mac an iPhone case games from the App Store or even a service like Apple Music or Apple TV. In order to facilitate the few swipe. Apple Card exists primarily as a virtual credit with payments made either via contactless payments on an iPhone over Apple Pay or as online transactions.

When you apply for a credit card no matter who the card provider is with the. After a soft launch on Aug.