In many cases sellers who register and file taxes in California already provide information on their Amazon business as part of their tax filings. This is often greater than the standard sales tax in CA which is 725.

California Sales Tax Collection And Remittance By Amazon General Selling Questions Amazon Seller Forums

California Sales Tax Collection And Remittance By Amazon General Selling Questions Amazon Seller Forums

Are Amazon Purchases subject to sales tax.

Amazon sales tax california. Textbooks rented from Warehouse Deals and shipped to destinations in Delaware are subject to tax. You can set that up within Amazon under Settings Tax Settings. E-commerce giants like Amazon and eBay will have to collect California sales tax on behalf of small online retailers that sell products through their platforms under a law Gov.

To learn more see a full list of taxable and tax-exempt items in California. States Are Getting Serious About Sales Tax We. Californias new marketplace facilitator rule will go into effect on October 1 2019CA Amazon Sales Tax.

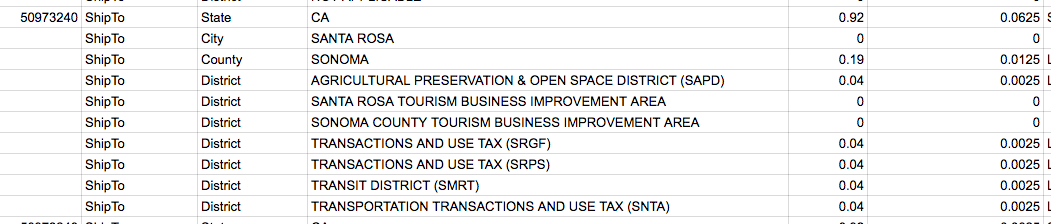

For this reason we recommend that Amazon FBA sellers set their TaxJar accounts to destination sourcing for the most accurate California sales tax reporting. Amazon sometimes I have found actually collects whatever the rate is in the area where the buyer is located. No tax is charged when purchasing gift cards.

You will basically be paying to California only the sales tax collected from California customers. However purchases paid for with gift cards may be subject to tax. But the Department of Tax and Fee Administration argues that under long-standing state law merely having a product for sale in an Amazon warehouse in California was enough to trigger an obligation.

California will follow other states in forcing Amazon to collect and remit sales tax on behalf of its 3rd party merchants. The alternative however is not to collect sales tax from your Amazon customers and to instead pay out of your profits. One less thing for me to do.

The next section allows you to exclude non-california sales no-tax items like shipping and any sales tax collected. However Amazon charges a fee of 29 per transaction in order to collect sales tax. Every quarter you will have to remit your sales tax collected to the State of California by filing your quarterlies.

There only about 9 states that actually have that requirement imposed on Amazon. How will this action affect you as an FBA seller. 46 rijen Amazon Tax Exemption Program ATEP Tax on Amazon Prime.

Keep in mind that Amazon charges 29 of each transaction in order to collect sales tax. According to the email we just received starting October 1st Amazon will be collecting all sales tax for California. While Californias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

For example if you live in California and have been selling on Amazon for two years but only started collecting sales tax one year ago then the CA Department of Tax and Fee Administration CDTFA may find that you owe the sales tax you should have collected from your buyers. Setting up sales tax collection on Amazon FBA. The form requires you to first report all sales amounts - what you charged the customer without regard to any fees you paid to amazon.

You will then need to collect sales tax on sales to California residents via Amazons system. In November 2018 Amazon announced that it will comply with the State of California Department of Tax and Fee Administrations demand to provide third-party seller data. Amazons internal sales tax engine collects sales tax in California based on the sales tax rate at the buyers ship-to location.

With this being implemented and Amazon being my only selling channel I will have nothing to pay. TaxJar reprinted the letter Amazon sent to sellers which read in part To comply with our obligations under the law we plan to provide this information to the CDTFA by November 6 2018. In California the easiest solution for small business owners and the state of California would be for Amazon to collect sales tax on behalf of sellers--the cost of compliance and enforcement would.

This page describes the taxability of amazon purchases in California. However I am located in California have a seller permit and pay my sales tax quarterly. To set up Amazon tax calculation services log in to Seller Central and select Tax Settings from the Settings drop-down menu as indicated below.

California is not a state that requires Amazon to collect and remit tax directly to us on behalf of its sellers and there is no expectation for that to occur any time soon in the future as well.

Help W Ca Sales Tax I M In Ny Selling On Amazon Amazon Seller Forums

Help W Ca Sales Tax I M In Ny Selling On Amazon Amazon Seller Forums

California Sale Tax General Selling Questions Amazon Seller Forums

California Sale Tax General Selling Questions Amazon Seller Forums

California Amazon Sellers Reporting Sales Tax Disclosuretaxjar Blog

California Amazon Sellers Reporting Sales Tax Disclosuretaxjar Blog

Ca Changed Their Requirements On Sales Tax Just Got The Email Today Selling On Amazon Amazon Seller Forums

Ca Changed Their Requirements On Sales Tax Just Got The Email Today Selling On Amazon Amazon Seller Forums

Help W Ca Sales Tax I M In Ny Selling On Amazon Amazon Seller Forums

Help W Ca Sales Tax I M In Ny Selling On Amazon Amazon Seller Forums

Amazon Sales Tax Everything You Need To Know Business 2 Community

Amazon Sales Tax Everything You Need To Know Business 2 Community

Since When Did The Policy Start That We Have To Pay Sales Tax In California On Used Books We Sell On Amazon Selling On Amazon Amazon Seller Forums

Since When Did The Policy Start That We Have To Pay Sales Tax In California On Used Books We Sell On Amazon Selling On Amazon Amazon Seller Forums

Amazon To Charge Sales Tax In 8 More States Jul 18 2012

Amazon To Charge Sales Tax In 8 More States Jul 18 2012

California Now Pursuing Amazon Sellers For Income Taxtaxjar Blog

California Now Pursuing Amazon Sellers For Income Taxtaxjar Blog

Taxjar Sales Tax Reports Vs Amazon Sales Tax Reportstaxjar Blog

Taxjar Sales Tax Reports Vs Amazon Sales Tax Reportstaxjar Blog

Sales Tax In California General Selling Questions Amazon Seller Forums

Sales Tax In California General Selling Questions Amazon Seller Forums

Sell On Amazon In California You D Better Collect Sales Tax

Sell On Amazon In California You D Better Collect Sales Tax

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.