Winner of LendingTrees 2019 Customer Satisfaction Award. The loan is based on PayPal sales and doesnt require a credit check.

Paypal S Smb Lending Division Hit 10 Billion In Cumulative Volume

Many small business owners who rely on PayPal to accept and make payments could also turn to the platform when in need of financing.

Paypal small business loan. The PayPal Business Loan program can provide funding from 5000 100000 for small businesses looking for quick decision-making and settlement. Because approval for these loans is based primarily on annual revenue its much easier for borrowers with low credit scores or new businesses to qualify. PayPal Commerce Platform Uses Machine Learning to Help Improve Compliance and Anti-Fraud Checks for Small Businesses TORONTO April 13 2021 PayPal today launched the PayPal Commerce Platform offering integrated payments and fraud protection features bolstered by machine learning for Canadian small.

PayPal business loans range from 5000 to 500000. The application process is simple and approved loans can be funded almost immediately. PayPals Working Capital business loans allow borrowers with established PayPal accounts to take out up to 97000 with their first loan and use their daily sales to repay the amount.

Eligibility is based on PayPal history and processing volume not a business or personal credit score like traditional sources. During the underwriting review of an application credit checks are performed on both the business owner and business and PayPal often. 2 To apply for PayPal Working Capital your business must have a PayPal Business or Premier account for at least 90 days and process a minimum of 15000 or for Premier accounts 20000 within those 90 days or within any time period less than or equal to 12 months.

You can borrow up to 500000 with terms of up to 52 weeks. The SBAs microloan program offers up to 50000 in loan funding to small businesses seeking capital to get started or expand. PayPal Business Loan can give you fast access to small business funding from 5k - 500k.

The business loan has a. PayPal also offers business term loans with automatic weekly repayments instead of monthly payments. And Australia or cash advance UK of a fixed amount with a single fixed fee.

1 The lender for PayPal Business Loan and PayPal Working Capital is WebBank Member FDIC. Other prominent fintechs including Funding Circle are awaiting approval to be direct lenders in the program. Three fintech companies PayPal Intuit QuickBooks Capital and Square Capital said that in recent days the federal government has approved them to make loans under the 349 billion Paycheck Protection Program.

Which Other Services Does PayPal Offer for Small Businesses. PayPal offers working capital loans to qualified business owners who use the service. That way if you ever want a business loan from PayPal youll.

While some small business loans or lines of credit require sizeable amounts of annual revenue for approval consideration PayPal only requires 42000. You will discover the PayPal Business Loan Application Start to Finish Approved in this video. READ FULL REVIEW.

PayPal Business Loans are available to businesses located within the United States that have been operating for at least nine months show no prior bankruptcies generate a minimum of 42000 in annual revenue and possess a PayPal Business Account. Approved applicants get the money in their business bank account in as fast as one or two business days. There are no periodic interest charges late fees pre-payment fees penalty fees or any other fees.

The amount you qualify for depends on the financial strength of your business and your credit score. Choose the right funding source for your business. The SBA also has an Office of Womens Business Ownership which has local offices that can help with grants and loans.

Named in US News World Reports list of Best Small Business Loans. The interest rates for microloans vary but are generally between 813. PayPal Working Capital is a business loan US.

PayPal also offers a business loan option that is designed for easier approval and repayment works as a percentage of sales. Unlike PayPal Working Capital PayPal Business Loans are not exclusively available to businesses that use PayPal to process payments. The lender for PayPal Business Loan and PayPal Working Capital is WebBank Member FDIC.

PayPal Working Capital is a business loan of a fixed amount with a single fixed fee. Since 2013 the company has made more than 15 billion in loans through its PayPal Working Capital program making PayPal one of the top five. Learn about business financing options from small business loans to innovative Fintech funding with PayPal.

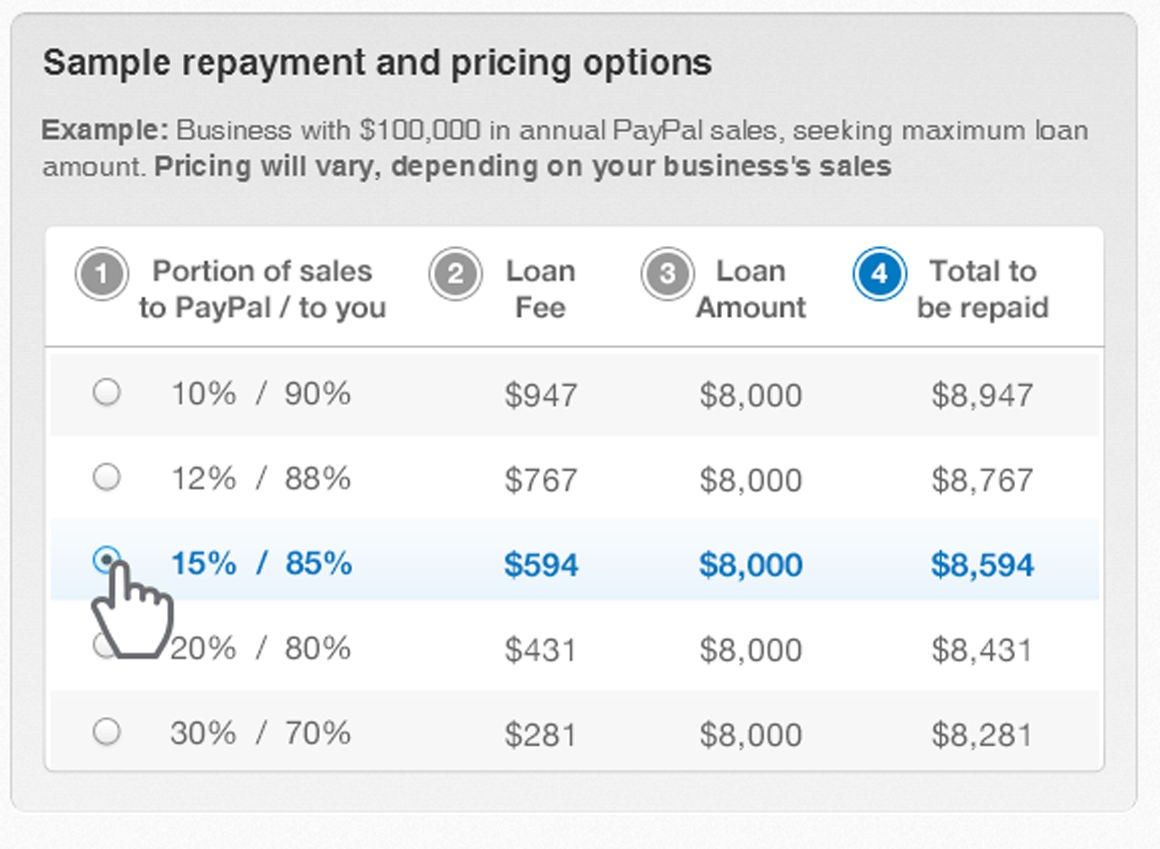

To apply for PayPal Working Capital your business must have a PayPal Business or Premier account for at least 90 days and process a minimum of 15000 or for Premier accounts 20000 within those 90 days or within any time period less than or equal to 12 months. What Are PayPal Business Loans. The loan and fee are repaid automatically with a percentage of your PayPal sales a minimum payment is required every 90 days.

Must have 250k in revenue minimum 3 years in business 600 FICO.

The Paypal Business Loan Launches In Canada For Small Business Owners

The Paypal Business Loan Launches In Canada For Small Business Owners

Checklist How To Get A Small Business Loan Paypal Us

Checklist How To Get A Small Business Loan Paypal Us

Get A Working Capital Paypal Loan That Can Skyrock Your Business Earnings Online Or Offline Soccergist

Get A Working Capital Paypal Loan That Can Skyrock Your Business Earnings Online Or Offline Soccergist

Paypal Expands Small Business Loans To Canadian Market Paymentsjournal

Paypal Expands Small Business Loans To Canadian Market Paymentsjournal

Checklist How To Get A Small Business Loan Paypal Us

Checklist How To Get A Small Business Loan Paypal Us

Paypal Business Loan Tips And Tricks Hq

Paypal Business Loan Tips And Tricks Hq

Paypal Business Loan Application Start To Finish Approved Youtube

Paypal Business Loan Application Start To Finish Approved Youtube

![]() Paypal Working Capital Loans How Does Paypal Working Capital Work

Paypal Working Capital Loans How Does Paypal Working Capital Work

Know And Compare Your Options For Business Funding Paypal

Know And Compare Your Options For Business Funding Paypal

Paypal Business Loans Review 2019 Business Com

Paypal Business Loans Review 2019 Business Com

![]() Paypal Business Loan Archives Mstwotoes

Paypal Business Loan Archives Mstwotoes

Paypal Business Loan Tips And Tricks Hq

Paypal Business Loan Tips And Tricks Hq

Paypal Launches Small Business Loan Program Pcworld

Paypal Launches Small Business Loan Program Pcworld

![]() Paypal Working Capital Loans How Does Paypal Working Capital Work

Paypal Working Capital Loans How Does Paypal Working Capital Work

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.