Competitive rates and an array of term options on CDs. They are offering me a First Premier Platinum card.

First Premier Credit Card Review Bad Option For Bad Credit Nerdwallet

First Premier Credit Card Review Bad Option For Bad Credit Nerdwallet

High-fee low-limit cards like First Premiers are available mainly to people with weak credit histories said Chi Chi Wu an attorney with the National Consumer Law Center which has urged CFPB.

First premier program fee. To open your new account and access your available credit pay your Program Fee or fund your Security Deposit in full today. A traditional FDIC-insured savings option with free Online and Mobile Banking. You may even qualify for immediate access to your available credit.

The following fees apply. This is not a card that we recommend using. For example if you spend 2000 on a week vacation abroad you would pay a foreign transaction fee of 60.

All i got was a 250 credit limit my first bill is already here. They are even willing to settle for a lower amount which I wont do. I was so wrong.

The First PREMIER Bank credit card is designed specifically for those with low credit scores. The First PREMIER Bank Mastercard Credit Card charges an application-processing fee an annual fee and a monthly fee. Congratulations on taking the first step to open your new account.

Unfortunately this doesnt mean youre guaranteed to be approved when you apply even if your credit score is higher than that of the typical applicant. Youll pay a one-time program fee to open the account which most card issuers dont charge. They will basically transfer my charged off amount to this card at 0 APR until it is paid in full.

Schedule and make electronic payments as needed. As mentioned earlier your credit limit with the First Premier Bank Credit Card will be 300 400 500 600 700 or 1000 depending on your creditworthiness. While reasons for denial vary they can be based on anything from your income to your credit report.

The First PREMIER Bank Credit Card has an extremely high APR and huge fees. Its has a 36 APR as of 12192019 which is about double the average. First PREMIER Bank Payment Application.

For higher balance accounts - the bigger the balance the higher the rate. The cards annual fee monthly fees and program fee vary based on your credit limit. If you have a 600 credit limit your first.

Fill out the information below to get. In addition to the one-time 25 - 95 processing fee First Premier credit cards charge a 75 annual fee the first year and a 45 - 49 annual fee each year after that. First Premier Bank credit card charges a foreign transaction fee of 3.

Now my available credit is 71. Your total fees are 75 exactly 25 of your limit. I came home from work tonight and found an offer in the mail from First Premier.

If you do not pay that fee within 85 days of. The First Premier customer service number is 800 987-5521. Then youll pay an annual fee and monthly fees that depend on your initial credit limit.

Expedite payment via direct deposit. Adobe Premiere Pro is a feature-packed video editing software that includes various features such as advanced audio options and collaborative tools with other Adobe software. For example if you get a credit limit increase of 200 youll have to pay a 50 fee.

Quick efficient and affordable self-service solution. But First Premier throws into an extra trouble. First Premier Bank - First Premier Credit Card Company.

However where some other cards provide this functionality for free First Premier charges 399 a month for the service. The exact amounts depend on the credit limit youre assigned but the processing fee could be anywhere from 25 to 95. The First Premier credit card has one of the highest interest rates around.

There are a few more fees associated with the First PREMIER Bank card that arent mentioned above which most credit cards dont charge. Schedule and manage outbound vendor and tax payments. First Premier Bank Rates Fees 2020 Review.

If you want to add authorized users to your account itll tack on another 29 to your annual fee per card. The bank can increase your credit limit after your account has been open for 13 months but it will charge you 25 of the increase when approved. If you have a 300 credit limit your first years annual fee is 75 and there are no monthly fees.

Annual fee monthly fees and program fee. Keep ready cash on hand with an array of savings options from First PREMIER Bank. The annual fee ranges from 75 to 125 the first year and 45 to 49 each year thereafter.

There is a one-time processing fee up to 95. Does First Premier Bank credit card have a foreign transaction fee. I have a 95 program fee a 29 account set-up fee a 7 monthly servicing fee and already the 48 annual fee.

Premiere Pro offers an expanded multi-cam editing option that allows for simple assembly of sequences regardless of the number of cameras used for filming. Set up and schedule recurring vendor and tax payments.

First Premier Credit Card Is It The Best Card To Improve Your Credit

First Premier Credit Card Is It The Best Card To Improve Your Credit

2021 Review First Premier Bank Mastercard High Risk Little Reward

2021 Review First Premier Bank Mastercard High Risk Little Reward

First Premier Bank Credit Card Info Reviews Credit Card Insider

First Premier Bank Credit Card Info Reviews Credit Card Insider

First Premier Credit Card Mastercard Review 2021 Login And Reviews

First Premier Credit Card Mastercard Review 2021 Login And Reviews

First Premier Bank Credit Card Review The Points Guy

First Premier Bank Credit Card Review The Points Guy

The 4 Worst Credit Cards And What To Consider Instead

The 4 Worst Credit Cards And What To Consider Instead

:max_bytes(150000):strip_icc()/first-premier-bank-secured-card-acfd44e0854345989fb6599199197294.jpg) First Premier Bank Gold Mastercard

First Premier Bank Gold Mastercard

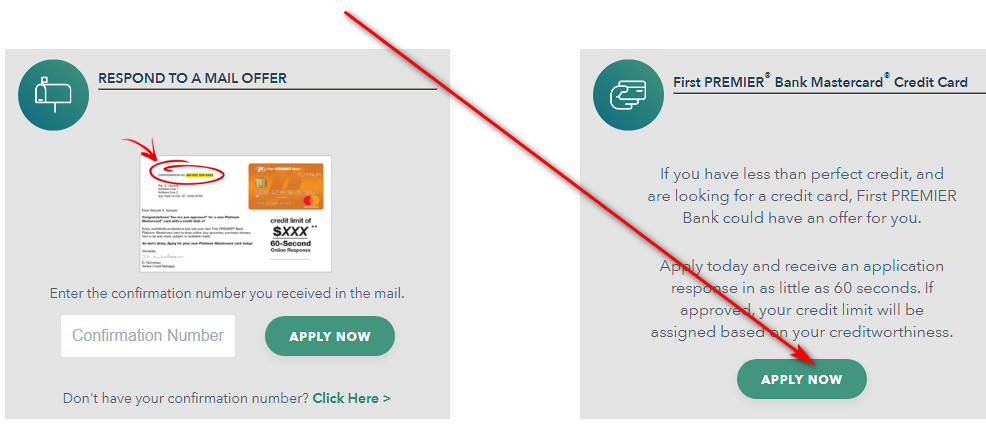

First Premier Bank Platinumoffer Pre Approved Confirmation Number

First Premier Bank Platinumoffer Pre Approved Confirmation Number

First Premier Credit Card Mastercard Review 2021 Login And Reviews

First Premier Credit Card Mastercard Review 2021 Login And Reviews

First Premier Bank Credit Card Review The Points Guy

First Premier Bank Credit Card Review The Points Guy

First Premier Bank Credit Card Review The Points Guy

First Premier Bank Credit Card Review The Points Guy

:max_bytes(150000):strip_icc()/first_premier_bank_gold_credit_card_FINAL-00e47c55a49844d7a362151b0bbe6f78.png) First Premier Bank Gold Mastercard

First Premier Bank Gold Mastercard

First Premier Bank Credit Card Review The Points Guy

First Premier Bank Credit Card Review The Points Guy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.