The following tables show the returns of each Investment Portfolio over the time period s indicated. YTD return as of 042221 -045.

Why A 529 College Savings Plan T Rowe Price

Why A 529 College Savings Plan T Rowe Price

Read and consider it carefully before investing.

529 plan rate of return. The assumed asset allocation for the analysis uses three asset classes and a generic target date asset allocation appropriate for college savers. The Program Description includes investment objectives risks charges expenses and other information. Unit price principal value and return will vary and you may have a gain or loss when you sell your units.

We provide everything you need know to chose the right plan. Since inception average annual return as of 033121 274. For more information about The Vanguard 529 College Savings Plan download a Program Description or request one by calling 866-734-4530.

The following table summarizes the investment return for each of the investment options net of administrative fees offered under the Florida 529 Savings Plan. 10 year average annual return as of 033121 -. 1 year return as of 033121 214.

A 529 plan is a type of savings and investment account in which money grows tax-free as long as the withdrawals are for qualified education expenses. Effective 2320 Franklin Templeton 529 College Savings Program will reduce the pricing schedule for twelve Class A Age-Based portfolios. 5 year average annual return as of 033121 -.

That means if you invest 5000 today in a mutual fund with an annual investment return of 6 percent in 18 years you will have 12074. When choosing what funds to invest in we suggest taking a look at the 529 investment performance. Updated Pricing Schedule for Class A 529 Age-Based portfolios.

The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits such as financial aid scholarship funds and protection from creditors not otherwise available to you by investing in my529. Upromise says that some members are earning at least 1000 per year - thats almost everything you need to fully fund a 529 plan. Current performance may be lower or higher than the quoted past performance which cannot guarantee future results.

Marginal tax bracket Unlike the tax-deferred 529 plan enter the tax rate you would pay on any earnings in an alternative taxable college savings account. The Vanguard Group Inc serves as the Investment Manager and through its affiliate Vanguard Marketing Corporation markets and distributes the Plan. Much like the way 401k plans revolutionized the world of retirement savings a few decades ago 529 plans have changed the world of education savings.

The Right Information for a Bright Future. Each Managed Investment Portfolio is a separate Investment Portfolio. 3 year average annual return as of 033121 312.

Before-tax return on savings The return you anticipate to receive on your college savings accounts. Franklin Age-Based Conservative Allocation Age 9 - 10 Years Portfolio Franklin Aged-Based Conservative Allocation Age. 529 portfolio performance.

This rate will be used for comparison purposes. Lastly the underlying effective rates of return are assumed to be between 1 and 3. Plus right now you can get a 25 bonus if you link your 529 plan within 30 days of signing up.

The following portfolios will have a reduced maximum sales charge rate of 375. However the free online 529 Calculator designed by Calculator Pro allows you to get an accurate idea of just what your financial future will look like when you have the right 529 plan in place. For information log in to your account or call 1-800-552-GRAD 4723.

An overview of 529 plans. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the Board of Trustees of the College Savings Plans of Nevada chaired by the Nevada State Treasurer. The Period Ending March 31 2021.

Congress created 529 plans in 1996 in a piece of legislation that had little to do with college the Small Business Job Protection Act. However a 529 plan with the same initial investment and annual investment return would only leave you with 11647 a difference of 427. This calculator is a simple tool.

You can earn anywhere from 1 to 25 back at different retailers.

Determining How Much To Contribute To A 529 Plan Not Too Much

Determining How Much To Contribute To A 529 Plan Not Too Much

Can I Use A 529 Plan For K 12 Expenses Edchoice

Can I Use A 529 Plan For K 12 Expenses Edchoice

How To Maximize College Savings With A Savvy 529 Plan

How To Maximize College Savings With A Savvy 529 Plan

Determining How Much To Contribute To A 529 Plan Not Too Much

Determining How Much To Contribute To A 529 Plan Not Too Much

Saving Strategies Texas College Savings Plan

Saving Strategies Texas College Savings Plan

Basics Of 529 Plans New Savers Virginia529

Using 529 Plans For K 12 School Tuition

Using 529 Plans For K 12 School Tuition

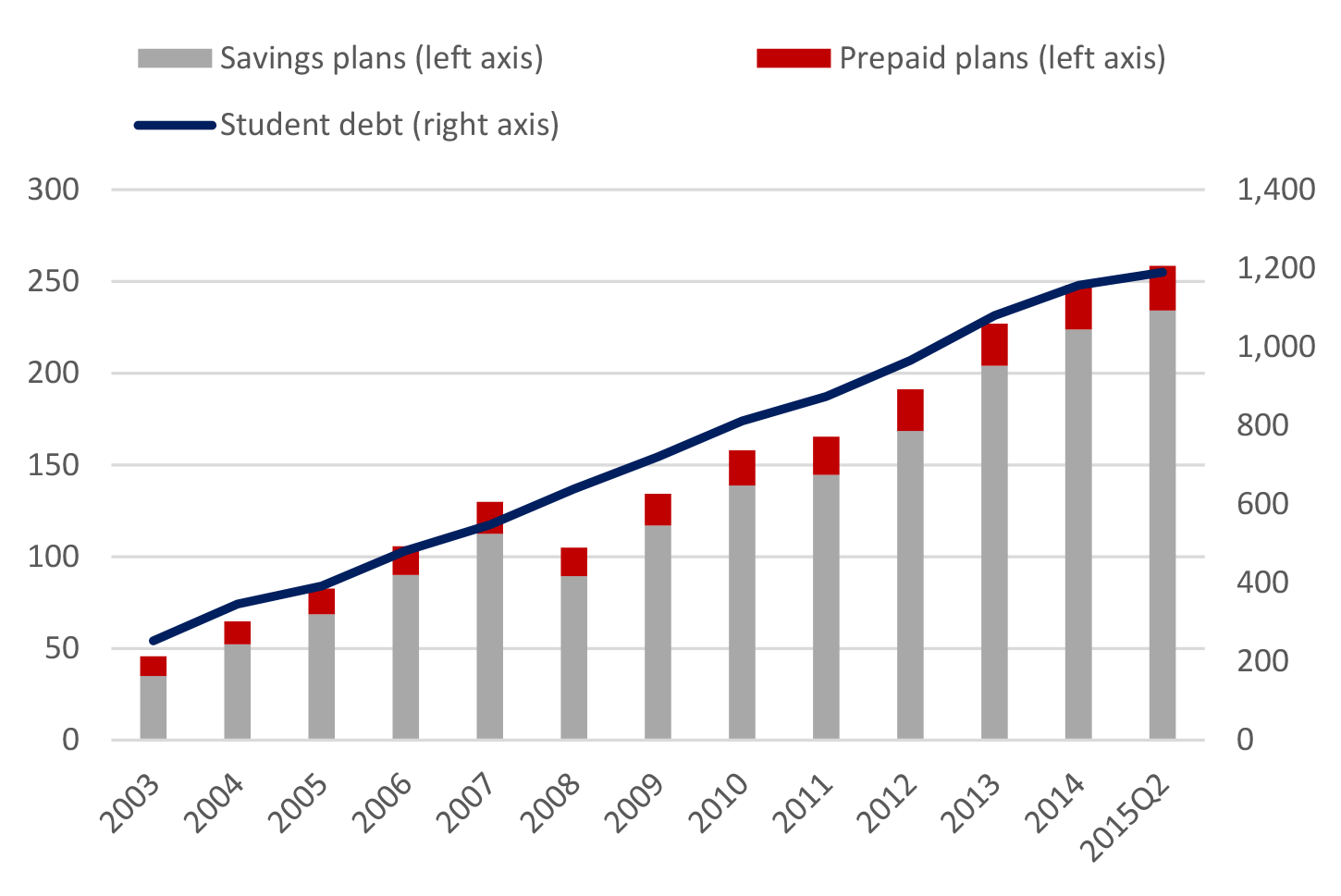

Frb Feds Notes Saving For College And Section 529 Plans

Frb Feds Notes Saving For College And Section 529 Plans

About 529 College Savings Florida 529 Plan Florida Prepaid

Save Regularly Lonestar 529 Plan

Save Regularly Lonestar 529 Plan

Determining How Much To Contribute To A 529 Plan Not Too Much

Determining How Much To Contribute To A 529 Plan Not Too Much

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.