The low-risk nature of these investments does not come without tradeoffs. For the moment lets assume its in an IRA and the only choices we are considering are the Vanguard Total Bond Market Index Fund and CDs.

/GettyImages-655465522-36cf791ef25e438288b350a88a7039b9.jpg) Muni Bonds Vs Bond Funds Better Together

Muni Bonds Vs Bond Funds Better Together

CD APYs typically rise as interest rates go up.

Municipal bonds vs cds. And because municipal bonds historically have generated higher returns than CDs your clients may not have to invest as much to generate that income leaving additional assets to invest in a conservatively managed stock fund with the goal of outpacing inflation. In todays market I can get a four- or five-year CD for 450 AAA with no risk and no premium. Municipal bonds and Certificates of Deposit CD are good investments for your safe money but they are very different.

You can buy them both from your bank or broker. If no credit. As with a CD you tie up your money for a fixed term in exchange for interest at a fixed rate but unlike a CD a bond can be sold before it.

A low historical default rate Municipal bonds have been an asset class with limited. When buying bonds you may have to pay some trading costs and other fees upfront. CDs come with FDIC insurance of up to 250000 per account-holder.

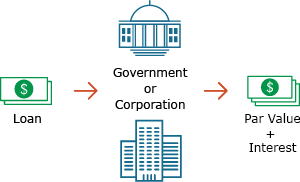

Corporate and municipal bonds can offer much higher rates than CDs because of their relative risk. Overall bonds present a lower risk than CDs. This is because the federal government often backs bonds.

However one difference between the two is that CDs generally offer easy access charge no fees and accept low minimum investments while bonds are seldom free of fees. When interest rates rise bond prices decrease. If Im buying an A-rated muni bond I want at least 25 to 30 above prime.

The protection buyer pays the protection seller a periodical premium similar to an insurance premium in return for protection against a credit event of the underlying debt instruments issuer. Be sure to calculate the after-tax returns of. CDS Economics CDSs are essentially a form of insurance.

Some munis might even have higher yields than some corporate bonds. These tend to generate higher interest rates than savings accounts or even the best money market accounts. Governments municipalities and companies issue bonds for varying durations with diverse interest or.

For people in a high tax bracket investing in taxable accounts muni bonds are still a better deal than CDs. Credit Default Swaps on Municipal Bonds 1. That can make municipal bonds particularly attractive to investors subject to higher personal income tax rates.

In general though yields on municipal bonds are often higher than US. Like other bonds munis are considered somewhat less risky than stocks. And like bonds CDs have a point of maturity which indicates when youll get the money you invested back.

Municipal Bond Forum CDs vs. And credit unions which offer their own version of CDs called share certificates also carry 250000 of federal insurance via. Due to their tax advantages federal and municipal bonds will leave you with more money in your pocket than a CD offering the exact same interest rate.

Bonds come in a wider variety than CDs and are considered a loan to the issuer. That means that a bond will lose market value if. A crucial difference between CDs and bonds lies in how they react to increased interest rates.

Municipal bonds generally pay low interest because they are exempt from income tax and if. Unlike CDs Treasuries or corporate bonds the interest paid on municipal bonds is free from federal and in some cases state and local income taxes. A bond is a loan to a company or the government.

A certificate of deposit CD is a type of savings vehicle issued by a bank or credit union. As a result youre likely to see the potential for better returns with stocks than with municipal bonds. CDs come with FDIC insurance of up to 250000 per account-holder.

While the FDIC insures cDs for amounts up to 250000 per bank the overall risk of investing in CDs is still slightly higher than bonds. And credit unions which offer their own version of CDs called share certificates. The difference will be most pronounced for investors in high tax brackets.

/Municipal-bonds-investing-for-income-benefits-35598aefcf37427cad5d206750833699.png) Benefits Of Investing In Municipal Bonds For Income

Benefits Of Investing In Municipal Bonds For Income

Cds Vs Bonds Factors To Consider Fortunebuilders

Cds Vs Bonds Factors To Consider Fortunebuilders

Cds Vs Bonds What S The Difference Nerdwallet

Cds Vs Bonds What S The Difference Nerdwallet

How To Choose Between Bonds Vs Cds Bonds Us News

How To Choose Between Bonds Vs Cds Bonds Us News

Cds Vs Munis Investment Calculator Putnam Investments

/bonds-5bfc37fd46e0fb00517f4bf5.jpg) Cds Vs Bonds What S The Difference

Cds Vs Bonds What S The Difference

Why Investors Don T Realize Cds Are A Better Deal Than Bonds

Why Investors Don T Realize Cds Are A Better Deal Than Bonds

Investing In Bonds Wells Fargo Advisors

Investing In Bonds Wells Fargo Advisors

/municipal-bonds-what-are-they-and-how-do-they-work-3305607-FINAL-75578b195af448588b93a7fced720a97.png) Municipal Bonds Definition How They Work Threats

Municipal Bonds Definition How They Work Threats

Bonds Vs Cds Similarities Major Differences And How To Choose

:max_bytes(150000):strip_icc()/GettyImages-689019164-fb16a968ac1e44e69b1a7013180aba7b.jpg) Municipal Bonds Vs Taxable Bonds And Cds

Municipal Bonds Vs Taxable Bonds And Cds

:max_bytes(150000):strip_icc()/GettyImages-656680302-b9ac142099da451e8fa31a60d9fa9a33.jpg) Municipal Bonds Vs Taxable Bonds And Cds

Municipal Bonds Vs Taxable Bonds And Cds

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.