Day traders need at least 25000 in an account if they want to make more than 3 day trades within a 5 calendar day period. Investors now hold onto their shares 08 years on average before selling them.

How Much Does The Average Person Make In The Stock Market Quora

For the bottom half of families it was just under 54000.

How much do people invest in stocks. Ideally you want 5000 or more. In your 60s. Most investors have a.

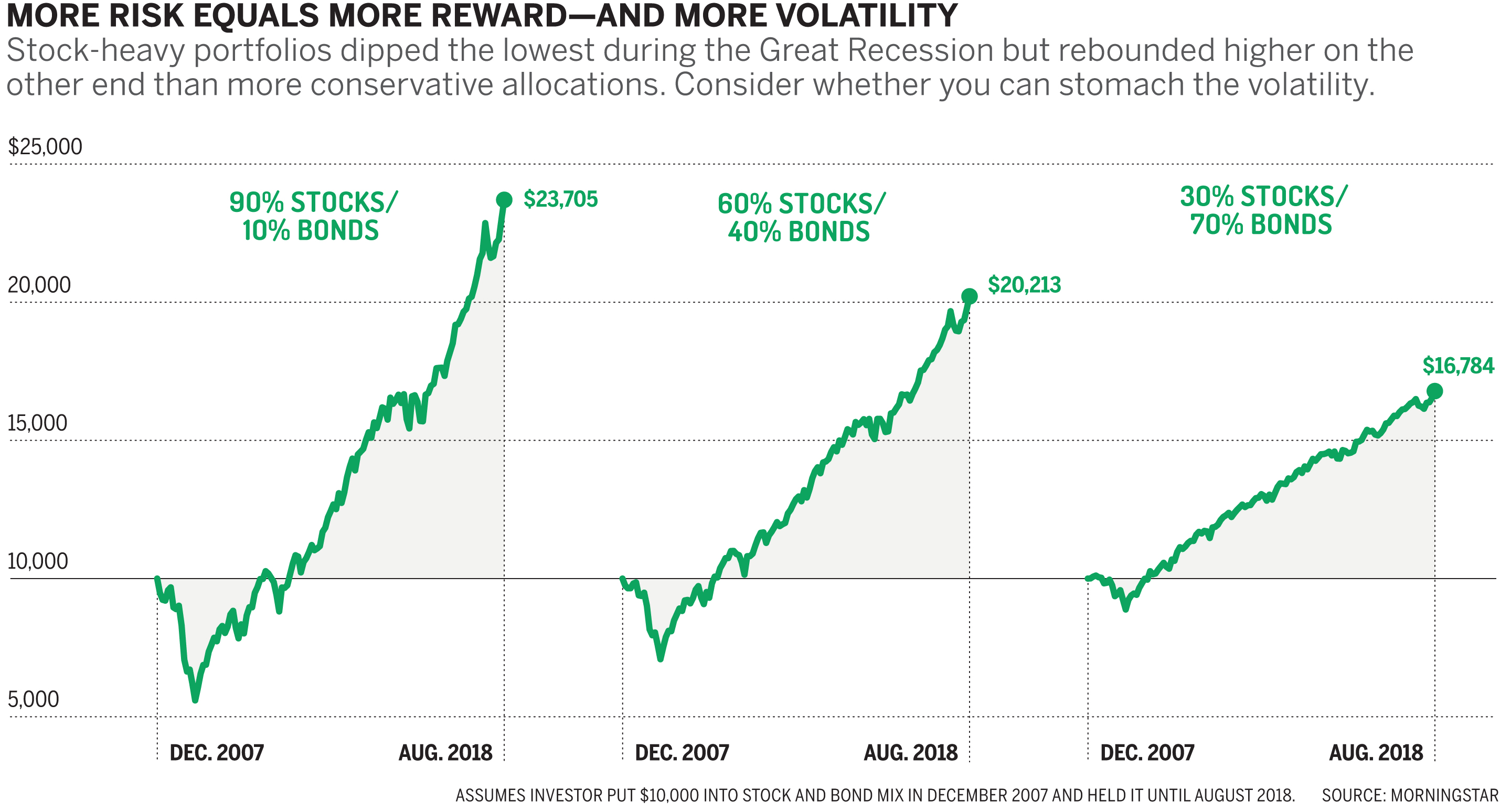

These stocks usually between 001 to 200. But even among those with annual family incomes of less than 35000 about one-in-five have assets in the stock market. You now have 20000 great.

But if the share price went down to 950 in the second month youd be able to buy 526 shares as the shares are at a lower price. However had the investor picked stocks in 1810 he would have turned his 10000 in 56 billion. Dont Risk Your.

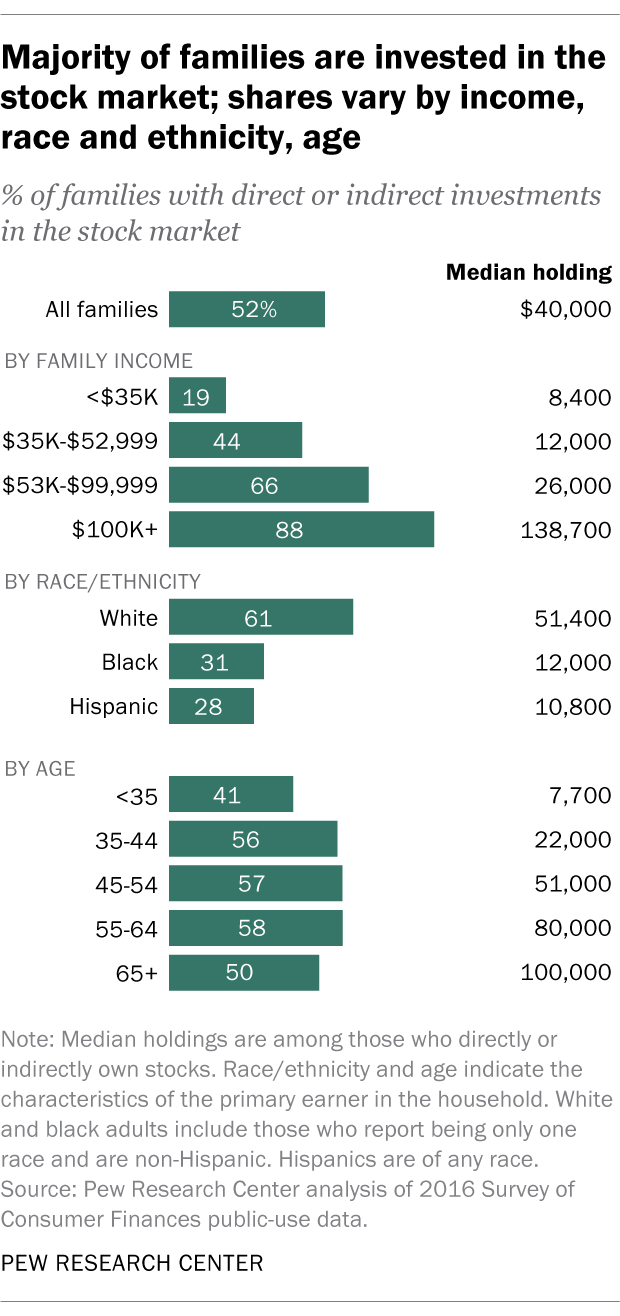

According to a recent Gallup poll only 37 of young Americans ages 35 and under said they owned stocks between 2017 and 2018 compared to the 61 of people over the age of 35 did own stocks. Finally your 401k provider may offer target-date retirement funds which do much of the asset allocation legwork for you because theyre made up of a mix of investments that changes over time depending on when you plan to retire. Go back to 1986 only this time assume that you divided that 10000 into 10 different investments of 1000 each just one of which was Microsoft.

You could swing trade penny stocks starting with at least 2500. How Much Money Should You Invest in Stocks. Another factor to consider when getting started is you.

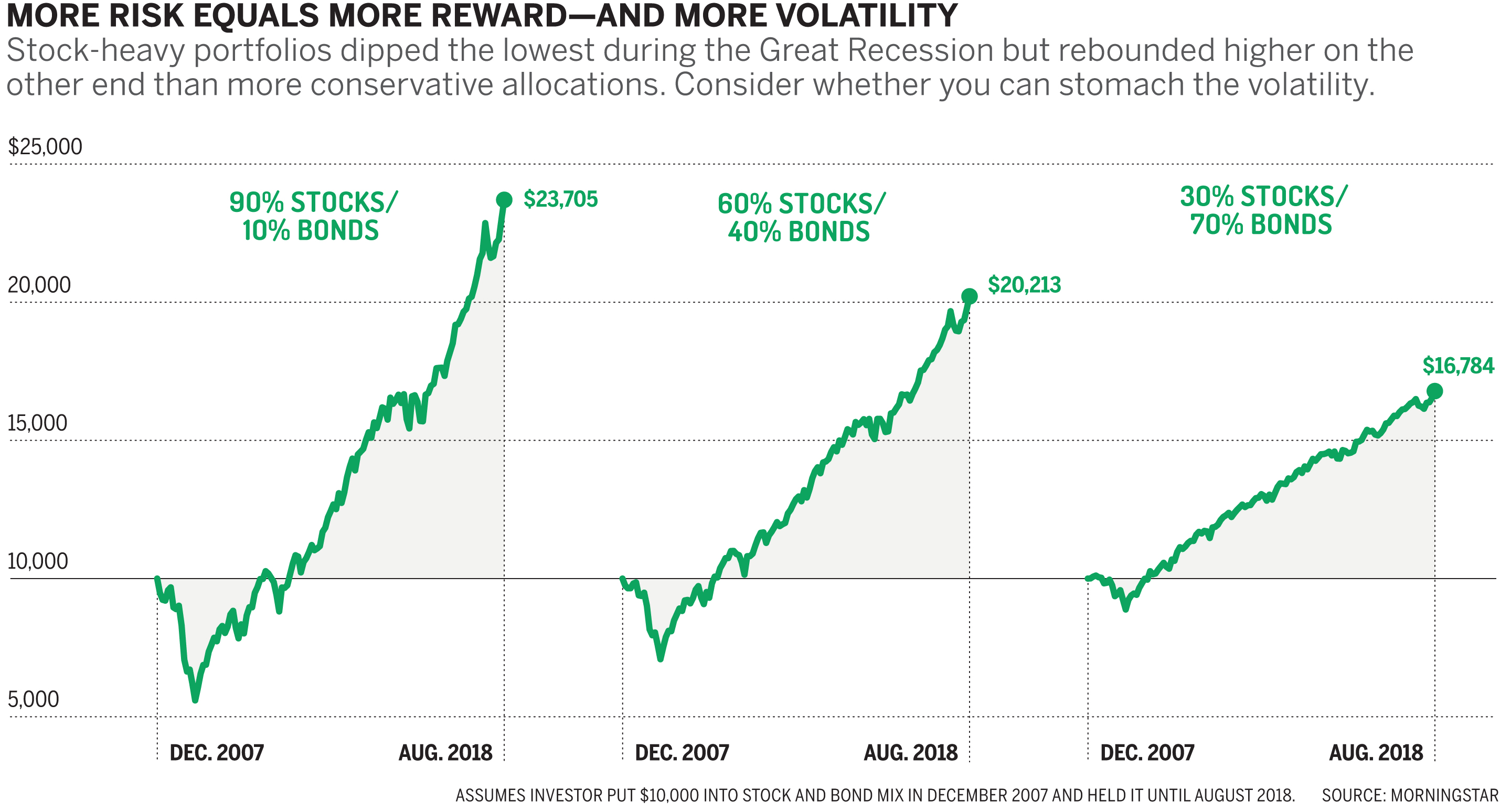

This is a better. But just in case this makes you giddy with enthusiasm SP 500 average returns were only 68 between 2007-2018. Thats the average return over the past 100 years or so.

You Need Enough Money to Properly Diversify Your Portfolio. If you are new to investing its important to note that the stock markets return on average is about 10 annually. The power of a single good investment is that it is able to overcome a lot of disasters.

After ten years you look in your account and see that your money has doubled. By 2021 that investment would be worth over 258 million. To casually buy and sell options you can get started for 1000.

In 2020 the percentages owning stock range from highs of. Stocks are still the big winner if you select a more realistic time frame. Stock ownership is strongly correlated with household income formal education age and race.

The amount of assets families hold in stocks also varies considerably by income. Stock Ownership Is Concentrated As of 2021 the top 10 percent of Americans owned an average of 969000 in stocks. Invest According to Your Risk Profile This investment plan assumes an average annual rate of return of 65 which is achievable based on the historical return of the stock market over the last.

You Need Enough Money to Protect Your Profits from Trading Fees. The average stocks shares ISA account is worth 27000. 50 to 65 in stocks 25 to 35 in bonds and 5 to 15 in cash.

So rather than just getting 1000 shares for your 10000 two payments of 5000 buys you 1026 shares. The shares increase as income rises and among those with incomes above 100000 88 own stocks either directly or indirectly. Penny stocks sound cheap and are cheap so new investors are often ready to leap in.

The next 40 percent owned 132000 on average. Imagine you invest 10000 into a portfolio of stocks and leave it there for 10 years. In 1980 the average was 97 years representing a decline of 9175.

Or you can open a traditional non-tax-advantaged brokerage account and invest. Many people often ask how much do you need to invest in stocks. Between 1928 and 1966 the SP 500an index of 500 of the largest market-capitalization stockshas rewarded investors with 95 average annualized returns.

In reality you can start out by contributing as little as 50 to an IRA or 401 k and invest your money there. Now what if you have a substantially bigger amount to invest say 500000 or 1 million. Another element to consider is trading fees.

On an average we tend to get around 12 to 25 per year in Low Risk and Low Gain category we tend to get around 25 to 40 per year in medium risk and medium gain and under the high risk and high gain we could get 40 to 60 per year at normal situation provided we hold quality stocks for at. From 1967 to 2006 investors enjoyed a 101 average annualized return. Similarly rather than buying a few dozen stocks to hedge risk its still better to concentrate on no.

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png) Is It Possible To Make A Living Trading Stocks

Is It Possible To Make A Living Trading Stocks

How To Invest In Stocks Quick Start Guide For Beginners Nerdwallet

How To Invest In Stocks Quick Start Guide For Beginners Nerdwallet

What Percent Of Americans Own Stocks Financial Samurai

What Percent Of Americans Own Stocks Financial Samurai

How To Invest Money A Guide To Grow Your Wealth In 2021

How To Invest Money A Guide To Grow Your Wealth In 2021

What Percent Of Americans Own Stocks Financial Samurai

What Percent Of Americans Own Stocks Financial Samurai

/dotdash_Final_Reasons_to_Invest_in_Real_Estate_vs_Stocks_Sep_2020-01-295563d87e5544768126b5b0d8822891.jpg) Reasons To Invest In Real Estate Vs Stocks

Reasons To Invest In Real Estate Vs Stocks

How Many Shares Of Stock To Make 1 000 A Month 7 Popular Stocks

How Many Shares Of Stock To Make 1 000 A Month 7 Popular Stocks

Best Time S Of Day Week And Month To Trade Stocks

:strip_icc()/investing-terms-you-should-know-356338_FINAL-5c5af82146e0fb0001be7b2c.png) Investment Terms Everyone Should Know

Investment Terms Everyone Should Know

This Is The Right Amount Of Stocks To Own At Every Age Money

This Is The Right Amount Of Stocks To Own At Every Age Money

More Than Half Of U S Households Have Investment In Stock Market Pew Research Center

More Than Half Of U S Households Have Investment In Stock Market Pew Research Center

How To Invest Money The Smart Way To Grow Your Money

How To Invest Money The Smart Way To Grow Your Money

What Percentage Of Americans Owns Stock

What Percentage Of Americans Owns Stock

What S The Best Age To Start Investing The Motley Fool

What S The Best Age To Start Investing The Motley Fool

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.