Your insurance companys phone number is. The policyholders can cancel their health insurance plans during the free look period or anytime after the free look period.

How To Cancel Health Insurance

How To Cancel Health Insurance

Get in touch with the support department of the insurance company to submit the request for policy cancellation.

When to cancel health insurance. In most cases you can cancel your ACA insurance coverage for the same day and immediately stop accruing premium costs. To report the death of a person receiving Medicare benefits make sure you have the persons Social. You can terminate your healthcare coverage through Healthcaregov or buy calling customer service at 1-800-318-2596.

When and how you end your Marketplace plan depends on two things. Advertentie Get more out of your healthcare insurance. The cancellation takes effect on 1 January of the following year.

How to Cancel Health Insurance on Behalf of a Deceased Person To Cancel Medicare. Follow steps confirmed by the insurance rep. Is There A Penalty For Cancelling Your Health Coverage.

Within 3 months- 50 of the premium refunded. What should you keep in mind when cancelling your health insurance. If youre the main policyholder and someone on your plan dies you.

We must have received your cancellation before 1 January of the following year. If you want to send a cancellation letter by post you can use our cancellation letter template. Advertentie Get more out of your healthcare insurance.

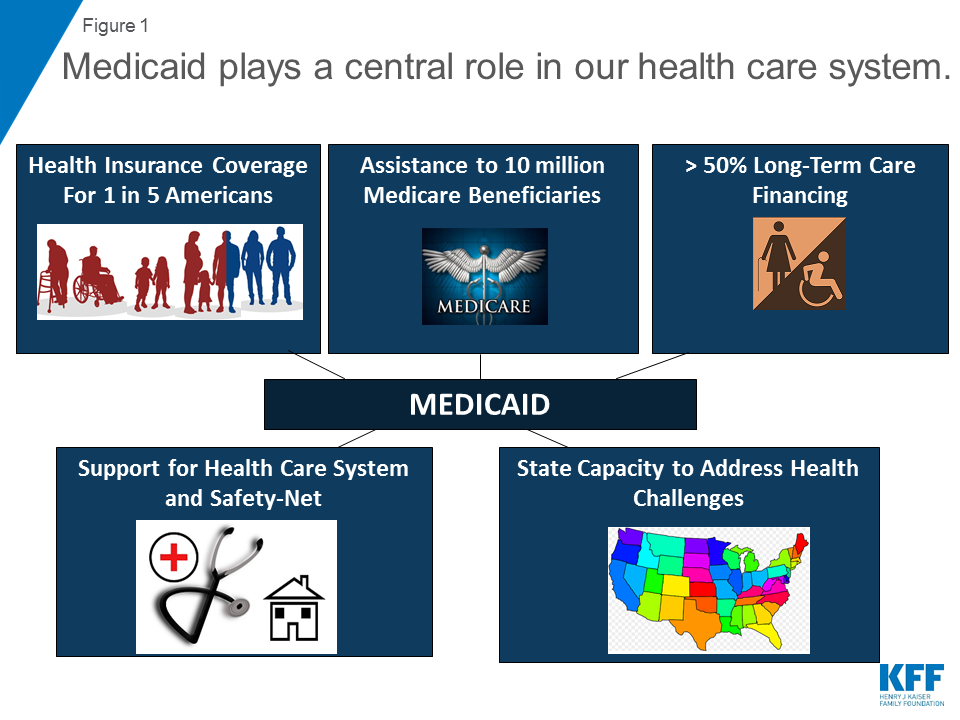

For government plans like Medicaid enrollees can often cancel health insurance at any time. Follow these seven tips when canceling or changing your individual health insurance policy. If the policy is cancelled- Within 1 month- 75 of the premium refunded.

If youre ending coverage for everyone on the application your termination can take effect as soon as the day you cancel or you can set the Marketplace coverage end date to a day in the future like if you know your new coverage will start on the first day of the following month. You can usually cancel your health insurance by sending your health insurance company an email or by arranging the cancellation via your personal page on their website. Call your insurance company.

However you will not receive 100 of the premium refund. You can also cancel your health insurance policy after the free-look period. Check out our affordable health plans and calculate your premium.

You can cancel your Obamacare insurance either from your online account or by speaking to a marketplace representative on the phone. On the whole its pretty easy to cancel this can normally be done on the phone or sometimes with a few clicks via your online health fund. If youre cancelling a privately purchased plan you can call your health insurance company directly.

Check out our affordable health plans and calculate your premium. Your insurers phone number should be printed on your policy health insurance card and your premium bills. Freelook period is the first 15 days of an offline policy and the first 30 days of the online health insurance policy.

You can feel free to cancel your Obamacare health plan at any time. They may also require that you fax or mail them a confirmation letter. During your call the insurance.

The reason youre ending coverage like if you get a job-based plan if you qualify for Medicaid or Medicare or if you simply want to end coverage If youre canceling the plan for everybody or just for some people. Sending an email or mailing a letter wont cut it. This is also the case if you are enrolling in Medicare and want to leave Obamacare.

Advertentie Compare Top Expat Health Insurance In Netherlands. - Free Quote - Fast Secure - 5 Star Service - Top Providers. Within 6 months- 25 of the premium refunded.

Get the Best Quote and Save 30 Today. To Cancel a Marketplace Health Insurance Plan. However you dont want to cancel your plan before youre covered with a new plan.

You cannot cancel your health insurance when you are in arrears. Your insurer may allow you to cancel over phone. Let us understand them below.

Cancellation During Free Look Period. As a general rule you can cancel any kind of medical insurance or dental insurance at any time for any reason. You can cancel your health insurance up to 31 December each year.

If you are reaching the age of 65 you can enroll in Medicare in the 3 months on either side of your birth month and can cancel your other insurance without issue. Steps to Cancel the Health Insurance Policy Now that you know the rules of health insurance policy cancellation lets take a look at the step by step process to cancel the policy.

/How-to-get-affordable-health-insurance-without-a-job-576565495f9b58346aa50c17.jpg)