County Department of Consumer Protection. Westchester County Property Tax Payments Annual Westchester County New York.

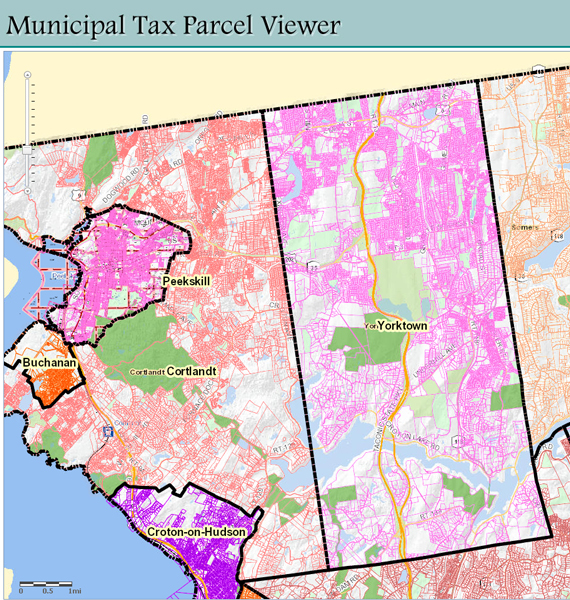

Westchester County Municipal Tax Parcel Viewer Town Of Yorktown New York

Westchester County Municipal Tax Parcel Viewer Town Of Yorktown New York

You may contact us either by mail phone or fax or send an e-mail to with your tax-related inquiries and questions.

Westchester county property tax. Taxes are computed and billed by the local city or town tax department. 2020 Special District Tax Rates. If you want to check your property assessment or other information on the assessment roll you can do so anytime by going to the assessment page of your municipal Web site.

Blvd White Plains NY 10601 Phone. These records can include Westchester County property tax assessments and assessment challenges appraisals and income taxes. Below are property tax rates since 2002.

Municipal Tax Parcel Viewer. 2020 City Town Tax Rates. Westchester County Property Tax Payments Annual Westchester County New York.

2020 Village Tax Rates. In Westchester County property taxes are levied by school districts local governments cities and towns on behalf of the county and special districts such as fire sewer water and library. Median Property Taxes Mortgage 10001.

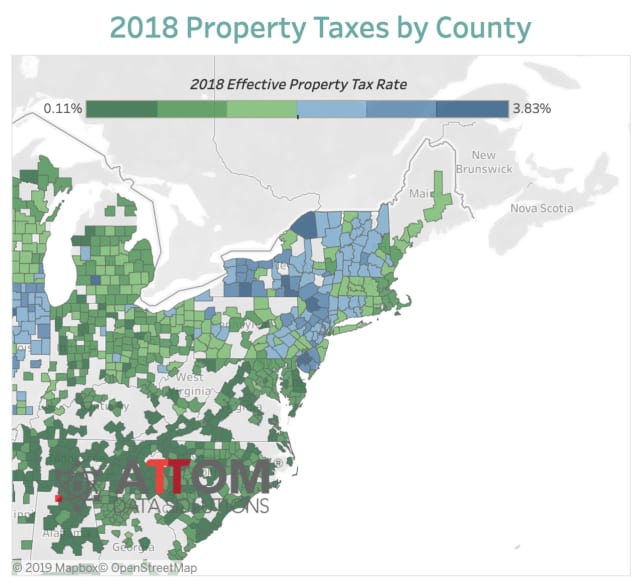

The average yearly property tax paid by Westchester County residents amounts to about 81 of their yearly income. Advertentie From Simple To Complex Taxes Filing With TurboTax Is Easy. Westchester pays the highest average property tax bills in the nation by some measures with the average homeowners tax bill north of 17000 when including school and local property taxes.

Median Property Taxes No Mortgage 10001. Martin Luther King Jr. 2020 School District Tax Rates.

County Property Tax Payment Dates. You Can Do It. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way.

Resources for Other Taxes. Please be advised that the geographic tax parcel information is provided as a public service to Westchester County residents for general information and planning purposes only and should not be relied upon as a sole informational source. County Department of Planning.

2020 Municipal County Tax Rates. You can use the New York property tax map to the left to compare Westchester Countys property tax to other counties in New York. The Westchester County Geographic Information Systems offers an interactive mapping application which can be used to view tax map parcels in Westchesters cities towns and villages.

Westchester County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Westchester County New York. Then find and click on the link for the assessment. Median Property Taxes No Mortgage 10001.

Westchester County is ranked 5th of the 3143 counties for property taxes as a percentage of median income. Office of the Westchester County Clerk 110 Dr. Westchester County does not assess or compute the individual property owners tax obligation.

We also provide a variety of additional resources that may serve in helping you understand the administration of the real property tax. 4 rijen SEE Detailed property tax report for 357 MT Holly Rd Westchester County NY In New York. You Can Do It.

The local city or town tax department also computes and bills the County portion of property taxes. Advertentie From Simple To Complex Taxes Filing With TurboTax Is Easy. Assessments are performed by the local city or town assesor.

914 995-3080 Fax. TurboTax Has Simple Step-By-Step Instructions To Help Along The Way. County Key Assessment Dates.

Median Property Taxes Mortgage 10001.