If these premiums arent tax-deductable the insurance payments are not taxable until they exceed the amounts you have paid for premiums. Combined the Social Security and Medicare taxes are called Federal Insurance Contributions Act FICA taxes and they can be up to 765 of your pay.

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Unemployment compensation is usually taxed in Delaware.

How much taxes do you have to pay on unemployment. How much tax youre going to pay on your unemployment benefits depends on the federal and state tax rate. Just make sure you file a tax return next year even if you cant afford to pay. The stimulus law-- passed in March -- included a 10200 tax.

Dont send it to the IRS. While the federal tax rate for unemployment benefits is 10 the state one varies from 4 to 10. 2 Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax.

For example if you paid. Changes in tax laws due to the American Rescue Plan mean that some Americans will receive a refund for the unemployment taxes they paid. The failure to file penalty is pretty steep at 5 per month up to 25 of your tax bill.

The IRS considers unemployment benefits taxable income When filing for tax year 2020 your unemployment checks will be counted as. Seven states Alaska Florida Nevada South Dakota Texas Washington and Wyoming levy no. Federal law allows any recipient to choose to have a flat 10 withheld from their benefits to cover part or all of their tax liability.

But know that if you owe taxes on your benefits next year that doesnt spell doomsday for your finances. Do you have to pay taxes on unemployment. To do that fill out Form W-4V Voluntary Withholding Request PDF and give it to the agency paying the benefits.

For the 2020 tax year however the American Rescue Plan Act allows single taxpayers with modified adjusted gross income of less than 150000 to exclude up to 10200 in unemployment insurance from income. If youre receiving unemployment benefits now consider whether or not you want to have income taxes withheld from. Youll also pay interest on the overdue balance.

However unemployment benefits received in 2020 are exempt from tax. Some extra money might be headed your way if you received unemployment benefits -- and paid taxes on those benefits -- in 2020. How much tax do you pay on it.

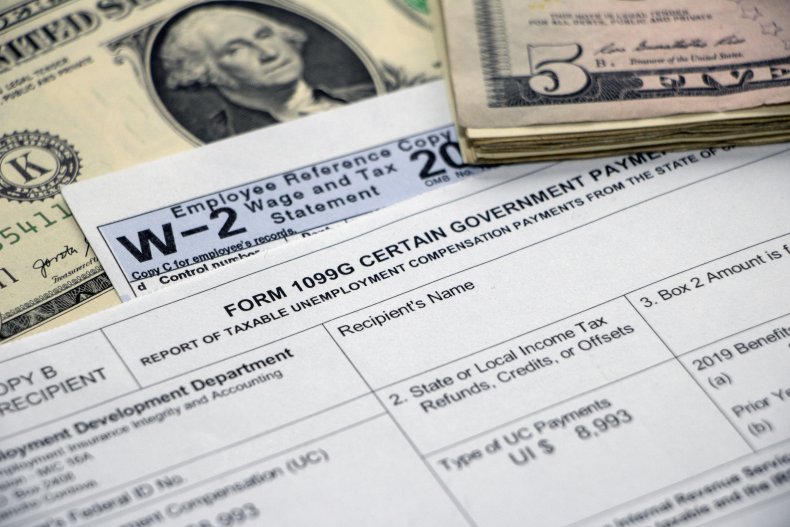

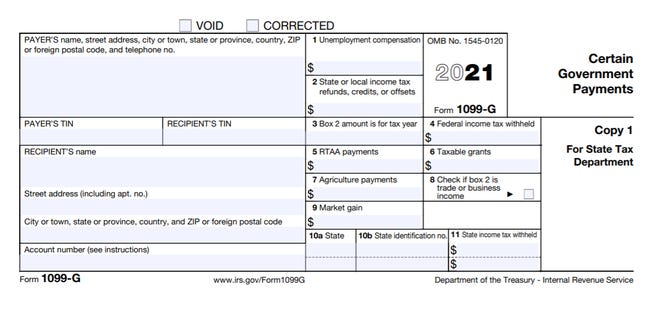

Your 1099-G will have the information youll need to transfer to your tax return. There is no wage base limit for Medicare tax and you must withhold a 09 percent additional Medicare Tax from wages you pay to an employee making in excess of 200000 in a calendar year. Married couples can exclude up to 10200 per person or a maximum 20400.

8 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay. The economic stimulus package passed in March allows for a. State Taxes on Unemployment Benefits.

Earlier this month the Internal Revenue Service said a recent law change allows certain people to not pay tax on some 2020 unemployment compensation. In addition employers must report and pay Federal Unemployment Tax FUTA separately from federal income tax Social Security and Medicare taxes. You will pay taxes on your unemployment compensation.

Most unemployment insurance premiums are paid by your employer and benefits are considered taxable income to you. Government Programs That You Contribute To. State Income Tax Range.

However taxpayers pay unemployment insurance premiums for governmental unemployment insurance. If the payor has its own withholding request form use it instead. You can use Form W-4V Voluntary Withholding Request to.

In some states youll only have to pay the federal tax. If the option to have taxes withheld is available you will. The 10200 exclusion currently only applies to 2020.

While you dont have to pay Social Security or Medicare taxes typically about a combined 765 rate while receiving unemployment benefits you. Interest rates are set quarterly and are usually based on the federal short-term interest rate plus 3. Federal income tax is withheld from unemployment benefits at a flat rate of 10.

You have to pay federal income taxes on your unemployment benefits as well as any applicable local and state income taxes. Pay them upfront either automatically or quarterly if you can. Some states withhold a percentage of your unemployment benefits to cover taxestypically 10.

Youll have to pay taxes on the remaining amount if you received more than 10200 in unemployment compensation. The interest rate for underpayments is currently 4 and will compound daily. But FICA taxes dont apply to unemployment benefits.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do You Know Your Unemployment Benefits Independent Contractor Tax Advisors

Do You Know Your Unemployment Benefits Independent Contractor Tax Advisors

How Much Do People Pay In Taxes Tax Foundation

How Much Do People Pay In Taxes Tax Foundation

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Don T Forget To Pay Taxes On Unemployment Benefits

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

How To Calculate Your Unemployment Benefits

How To Calculate Your Unemployment Benefits

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

What Is My State Unemployment Tax Rate 2021 Suta Rates By State

/how-to-calculate-your-unemployment-benefits-2064179-v2-5bb27c7646e0fb0026d9374f.png) How To Calculate Your Unemployment Benefits

How To Calculate Your Unemployment Benefits

Taxes On Unemployment Checks May Surprise Some

Taxes On Unemployment Checks May Surprise Some

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.