The increase has already been signed sealed and delivered buried in the pages of the 2017 Tax Cuts and Jobs Act. When are taxes coming.

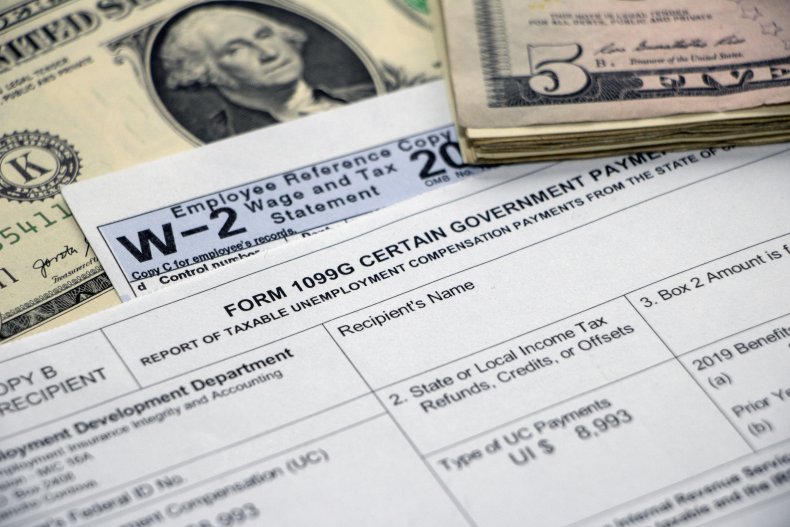

Tax Day Is Coming But There S Some Taxes You Might Have Missed

Tax Day Is Coming But There S Some Taxes You Might Have Missed

Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit.

When are taxes coming. When are taxes coming. Answered in 8 minutes by. 27 which is consistent with the start date in recent years.

Heres more info you need to know about filing taxes in 2020 including. 16 is the latest date Betterment will send out the Form 1099-BDIV which is for investment sales and dividends received in taxable accounts. 15years with H R Block.

Even so many portions of Trumps tax changes -- including the estate tax -- are set to expire at the end of 2025 so the threshold will automatically step down in the coming. We built our tax refund calendar around this guideline. Your 21 day average starts from this point - so you can usually expect your tax refund the last week of February or first week of March.

When can I expect my tax refund. While the IRS will start accepting and processing returns for the 2019 tax year as of January 27 2020 you have plenty more time to file taxes if you arent exactly ready just yet. The IRS extended the tax filing deadline to May 17 2021 for the 2020 tax year.

The TurboTax 2021 release date will be on December 3rd 2020. You will get personalized refund information based on the processing of your tax return. TurboTax is also releasing a Tax Refund Advance Program beginning December 3 2020.

Local governments rely heavily on property taxes to fund important projects like road improvements and maintenance law enforcement. If you have the Earned Income Tax Credit or Additional Child Tax Credit your refund does not start processing until February 15. This is also the new due date for taxes.

Key proposals by the White House involve an increase in long-term capital gains rates to income tax levels an increase in the corporate tax. President Trump and his congressional allies hoodwinked us. The IRS says that 90 of tax filers receive their refund within 21 days.

Tax hikes are coming. Combine that with the additional stimulus checks which require staffing and programming to send out and the last minute tax changes that passed in December which also require programming and testing the IRS is stretched to the limits. The amount that you owe each year depends on the assessed value of your property including your house itself and the land that it sits on.

The October 15 extension connected with Form 4868 remains the same. Property taxes sometimes referred to as a millage rate or a mill tax is a tax that you pay on real estate and other distinct types of property. The law they passed initially lowered taxes for most Americans but it built in automatic stepped tax increases every two years that begin in 2021 and that by 2027 would affect nearly everyone but people at the top of the economic.

Start to prepare and eFile your 2020 Tax Returns. Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various fees. This includes TurboTax Live and their team of tax experts ready with advice and answers to your tax questions for the 2020 2021 tax filing season.

Ask Your Own Tax Question. In 2021 the IRS will begin e-File on February 12 2021. The refund schedule below assumes that tax season for filing 2019 tax returns will start on Jan.

12 rather than the usual late January because it needed extra time to prepare for tax law changes from the Dec. Handle any of your last minute moves the week before just to be sure. As usual the last day to file taxes is April 15 this year.

The IRS didnt start accepting tax returns until Feb. April 15 2021 May 17 2021 will be the postponed tax deadline or Tax Day for 2020 Tax Returns. It uses a four-week timeframe for.

May 17th is the last day to file your taxes with the IRS for 2020 unless you request an extension. Its always been the safest fastest way to receive your refund but is even more so in these. Robin D Senior Tax Advisor 4 replied 5 years ago.

Robin D Senior Tax Advisor 4. What if I filed EITC or ACTC. The tool will provide an actual refund date as soon as the IRS processes your tax return and approves your refund.

27 relief package. In 2010 taxes collected by federal state and municipal.