Calculate the home price you can pay and the mortgage schedule you will need based on the payment down payment taxes and insurance you can afford. For somebody making 100000 a year the maximum purchase price on a new home should be somewhere between 250000 and 300000.

House Prices Relative To Income Around The World

Quickly find the maximum home price within your price range.

House price range for income. Once you are ready youll need to get professional mortgage advice on. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your total monthly debt including your anticipated monthly mortgage payment and other debts such as car or student loan payments should be no more than 43 of your pre-tax income. How to calculate how much house you can afford To produce estimates both Annual Property Taxes and Insurance are expressed here as percentages.

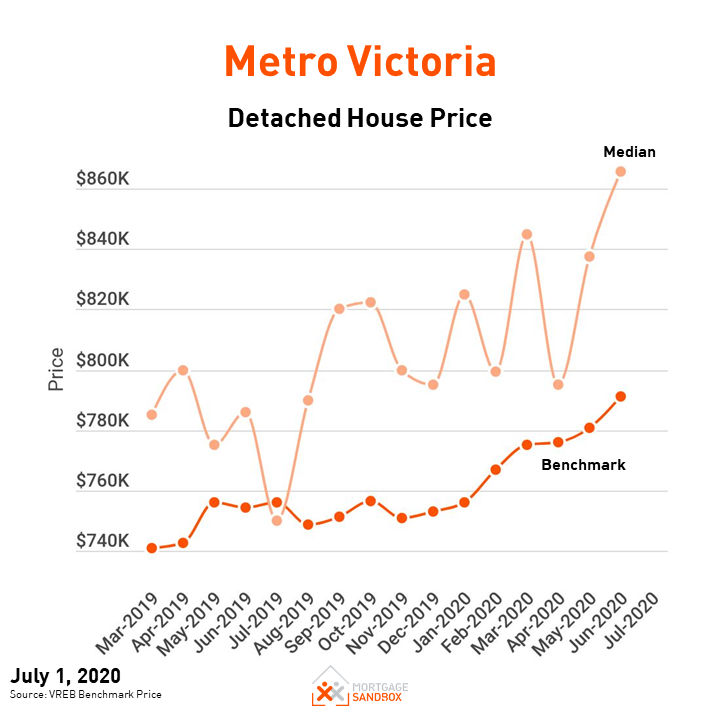

Calculate the Price You Can Afford Based on Your Income. It was among some of the least affordable countries analyzed along with countries such as. Median annual household income.

Generally speaking and depending upon your location they will generally range from about 05 to about 25 for Taxes and 05 to 1 or so for Insurance. Housing ratio equals combined principal interest taxes insurance monthly mortgage payment divided by your gross monthly income. Gross annual income.

The house-price-to-income ratio in Canada was equal to 12398 percent in the fourth quarter 2020. This calculator should give you a rough idea of your house price range based on the monthly payment you can afford for a mortgage. 25 of you gross monthly income for your mortage payment 33 of your monthly income for all expenses includes the mortage on the house ie - taxes utilities insurance etc.

Amount of money for a down payment and closing. The median income for first-time homebuyers in 2018 was 79400. In the 1960s owning a house was affordable in the Northeast with a price-to-income of 21.

To get that number back down to a monthly housing budget of 1250 youll need to lower the price of the house you can afford to 172600. Follow the 2836 debt-to-income rule This rule asserts that you do not want to spend more than 28 of your monthly income on housing-related expenses and not spend more than 36. The price-to-income ratio reached its peak around the 2008 financial crisis with 46 and dropped to 40 in 2017.

This was up from 75000 in 2017. Lets break down how everything factors in. 503 rânduri See comparison of indicators for residential property investment like apartment price to.

Average 630-689 After plugging in these numbers HomeLight estimates that you can afford a home that costs 275218 with monthly payments of 1850. For example a combined monthly mortgage payment of 1200 divided by gross monthly income of 4500 equals a housing ratio of 27. Average home value in Georgia.

During the housing bubble of 2006 the ratio exceeded 7 - in other words an average single family house in the United States cost more than 7 times the US. Or you can adjust your home price range so you can put down at least 20 in cash. Historically an average house in the US.

However home values started to outscale household income in the 1980s with a price-to-income ratio of 37 by 1990. Income levels have not kept pace with rising home prices. Then take your annual income and divide by 12 to determine your monthly income.

The Recommended Ratio of a House Price to Your Yearly Income Generally your total debt including mortgage payments shouldnt exceed 30 to 40 percent of. Cost around 5 times the yearly household income. Now if you want to play it very safe use your net income per month instead of your gross income.

The increase in median household income suggests stricter financing qualifications and an increase in home prices will result in shutting low-income buyers out of the market. The median price for existing homes 233000 and the median price for new construction homes 430244 are both up about 6 from June 2019.

![]() How Much House Can I Afford Interest Com

How Much House Can I Afford Interest Com

Affordability Calculator How Much House Can I Afford Zillow

Affordability Calculator How Much House Can I Afford Zillow

The Impact Of Income Distribution On House Prices Sciencedirect

The Impact Of Income Distribution On House Prices Sciencedirect

Affordability Pyramid Shows Housing Market Is Bottom Heavy Eye On Housing

Affordability Pyramid Shows Housing Market Is Bottom Heavy Eye On Housing

How To Worry About House Prices Freddie Mac

How To Worry About House Prices Freddie Mac

House Prices Still Skyrocketed In 2018 Real Estate Companies To Localize 2019 House Prices Can Be Suppressed

House Prices Still Skyrocketed In 2018 Real Estate Companies To Localize 2019 House Prices Can Be Suppressed

How Much House Can You Afford Money Under 30

How Much House Can You Afford Money Under 30

Am I Eligible For Affordable Housing Penang Property Talk

Am I Eligible For Affordable Housing Penang Property Talk

Median Housing Prices Poised To Fall Back Below 200k Otcmkts Cwsrf Seeking Alpha

Median Housing Prices Poised To Fall Back Below 200k Otcmkts Cwsrf Seeking Alpha

Investment Analysis Of Canadian Real Estate Market

Investment Analysis Of Canadian Real Estate Market

The Impact Of Income Distribution On House Prices Sciencedirect

The Impact Of Income Distribution On House Prices Sciencedirect

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.