If someone in the. Companies or the US-registered units of foreign companies that import goods.

Who Pays For Trump Tariffs Darcy Cartoon Cleveland Com

Who Pays For Trump Tariffs Darcy Cartoon Cleveland Com

Importers pay tariffs not exporters.

:max_bytes(150000):strip_icc()/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

Who pays tariffs. A tariff is a tax on imported goods. The purpose of a tariff is generally to protect domestic production and jobs though economists say other domestic sectors. Tariffs are a border-tax on the buyer not the seller.

President Trump again falsely said in a tweet on Monday that China pays tariffs. Others disagree claiming that tariffs will bite into budgets at home. What happens then is more complicated.

Proceeds go to the Treasury. A tariff is a tax on imports often known as a duty or a trade barrier. PRESIDENT Donald Trump reckons foreigners will pay the cost of the 200bn in tariffs he plans on Chinese goods.

In general the importer pays the tariff. Government by importing companies. So in the case of tariffs levied by the US.

Tariffs are a tax on imports. So the tariffs are paid to the US. What is a tariff.

But who pays those tariffs. Most importers of Chinese-made goods are US. Customs and Border Protection when.

They are paid by US-registered firms to US. A tariff is a border tax on the buyer not the sellertariffs make it more expensive for a buyer to import a good into the country. This is not true.

They make it more expensive for the buyer to import a good into the country. Despite what the President says it is almost always paid directly by the importer usually a domestic firm and never by the exporting country. Normally the people of the country imposing the tariff pay.

The structure of this updated Who Pays. Tariffs are taxes on importers paid to the customs authority of the country imposing the tariff EU member states then pass it to the EU after taking a cut to cover admin costs. Tariffs are paid to the customs authority of the country imposing the tariff.

Who pays for tariffs depends on specific circumstances such as the economic makeup of the country involved the industry the product and the competitive situation among other factors. Twitter reaction to Trumps trade aid tweet. When the United States levies a tariff on something it is the US importer who pays the tariff not the foreign exporter.

If you want to import a bunch of Toyota Camrys from Japan youre on the hook for the 25 US. Tariffs are collected by the national customs authority of the country into which the goods are being brought so tariffs on goods entering the UK will be paid to HMRC. On China those.

A tariff is a tax paid on a particular import or export. In the first instance when goods enter the country tariffs are paid by the importer of record who is generally a US. Guidance is broadly similar to the 2013 version and the core rule remains that the commissioner responsible for payment will be the clinical commissioning group of which the patients GP practice is a member with some exceptions to.

A tariff is a tax imposed by a government of a country or of a supranational union on imports or exports of goods. Foreign widgets will not continue to be imported into America for long if the widget sellers dont make a profit after all expenses including the expense of a tariff. The importer may b.

Besides being a source of revenue for the government import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to. What is a tariff. Lets get something straight.

Who pays tariffs. Lets start with a basic definition. Tariffs on imports coming into the United States for example are collected by Customs and Border Protection acting.

If a business imports 1000 steel rods from China for construction at 20 each for a total of 20000 the 25 tariff means that business pays an additional 5000. President Donald Trump has repeatedly claimed that America is collecting billions of dollars in tariffs from China but many American businesses argue that theyre the ones paying. Chinas government and companies in China do not pay tariffs directly.

Tariffs are paid by the importers on products they are importing from around the world. The fact is companies here pay tariffs to US. Customs for the goods they import into the United.

The president has frequently asserted that foreigners particularly the Chinese are paying the tariffs and bragged about the amount of money being brought in.

:max_bytes(150000):strip_icc()/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png) The Basics Of Tariffs And Trade Barriers

The Basics Of Tariffs And Trade Barriers

Who Pays The Tax On Imports From China Liberty Street Economics

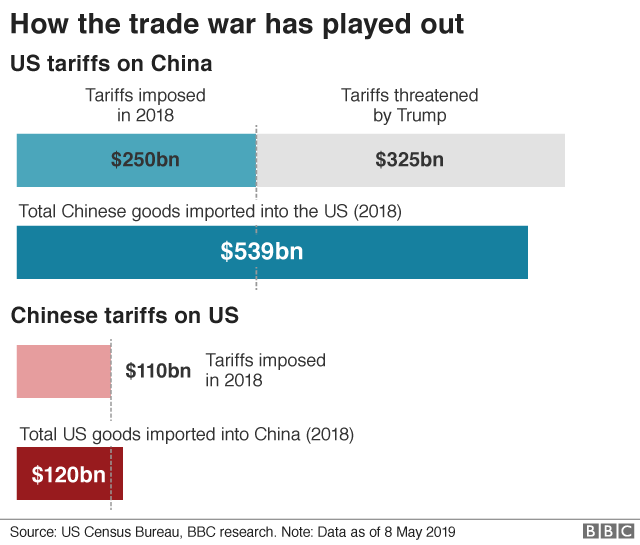

Who Loses Out In The Us China Trade War Bbc News

Who Loses Out In The Us China Trade War Bbc News

Who Actually Pays Tariffs Youtube

Who Actually Pays Tariffs Youtube

92 Percent Of Trump S China Tariff Proceeds Has Gone To Bail Out Angry Farmers Council On Foreign Relations

92 Percent Of Trump S China Tariff Proceeds Has Gone To Bail Out Angry Farmers Council On Foreign Relations

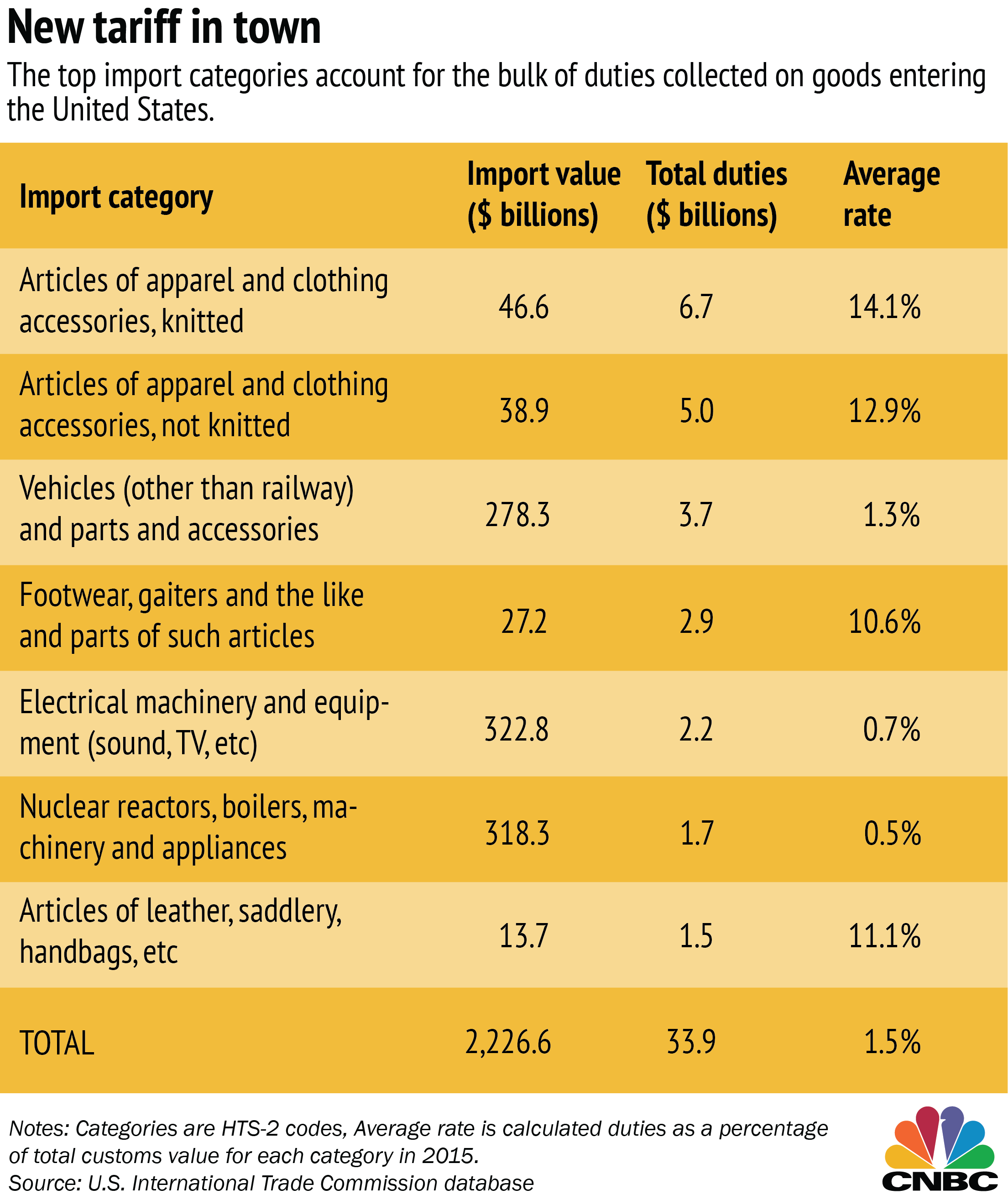

Trump Tariffs Countries And Products That Pay The Highest Us Tariffs

Trump Tariffs Countries And Products That Pay The Highest Us Tariffs

Counting The Costs Of Trade The Real Economy Blog

Counting The Costs Of Trade The Real Economy Blog

Trump Tariffs Countries And Products That Pay The Highest Us Tariffs

Trump Tariffs Countries And Products That Pay The Highest Us Tariffs

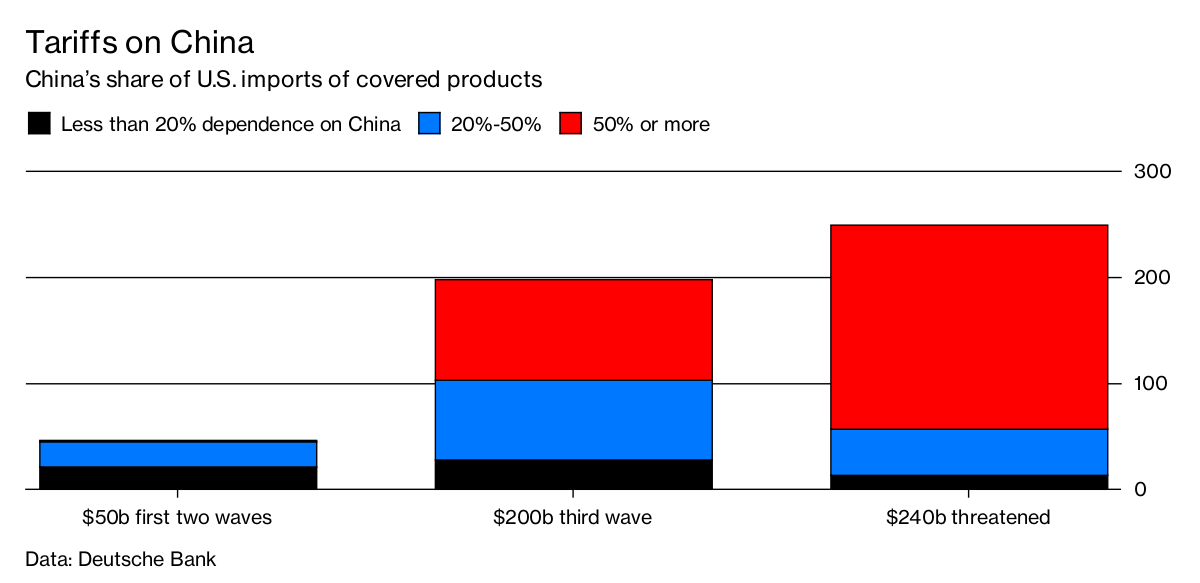

Who Pays For Trump S Tariffs Bloomberg

Who Pays For Trump S Tariffs Bloomberg

Are Tariffs Generally Good Or Bad For An Economy Quora

Who Pays The Tariffs On China Imports Youtube

Who Pays The Tariffs On China Imports Youtube

Who Pays The Tariffs By Economic Perspective

Who Pays The Tariffs By Economic Perspective

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png) The Basics Of Tariffs And Trade Barriers

The Basics Of Tariffs And Trade Barriers

Who Pays The Trump Tariffs We Do These Americans Say Wsj

Who Pays The Trump Tariffs We Do These Americans Say Wsj

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.